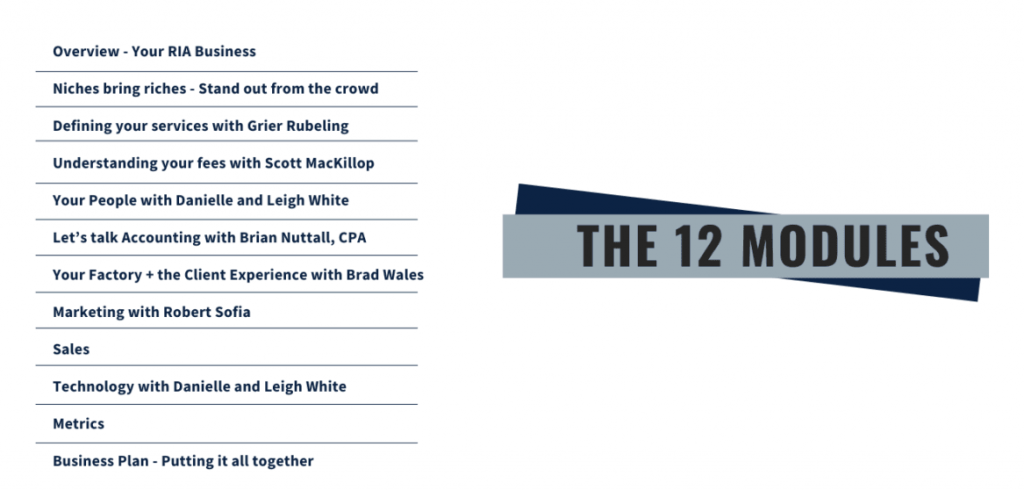

Find out how you can start and/or grow your RIA business with our legal and compliance expert guidance through this 12 module build out. We will walk you through simple and applicable approaches of business set up that has helped others just like you through the complexities of an RIA business to achieve success.

We have a team of industry veterans dedicated to sharing with you the secret ingredients of a successful RIA business. The will spill the tips and strategies for success they wish they knew when starting their own businesses.

You will walk away with a detailed business plan outlining the specific goals and strategies for your business to implement immediately. This business plan will allow you to put the structure in place to begin building your business which will ultimately lead to you firing yourself from the tasks that your team is now able to accomplish for you – GIVING YOU BACK YOUR TIME.

This is valued at 10s of thousands of dollars if we were billing you by the hour – instead we are offering our expertise to you for a one time cost of $1495! The info is spread across 12 modules so you can go at your own pace. This is exactly what you need to take your business next level. Enroll now hassle free and we will contact you to complete registration. 90 DAY MONEY BACK GUARANTEE IF YOU AREN’T SATISFIED.

Leila Shaver is the Founder and Managing Partner of My RIA Lawyer. Leila brings a decade of experience providing legal and compliance guidance to the financial services industry with a healthy dose of energy, fun and full transparency. Her boldness with regulators, comfort with working in the gray, and experience as CCO and General Counsel to multi-billion dollar companies, has made her the go-to provider in the independent space. Leila is sought after for not only her expertise, but her willingness to help business owners meet their business goals while complying with state and federal regulation. Changing the experience clients have with My RIA Lawyer, Leila is changing how firm owners see compliance and legal providers, not as business prevention departments, but business growth consultants.

Brian is one of the founding managers of Elevate and a specialist in ownership issues. In addition to tax and accounting expertise, he brings a legal understanding to the table, giving his clients critical perspective in the face of complicated challenges. When it comes to helping RIA firms grow, the knowledge Brian has amassed throughout his career allows him to advise on a range of solutions. He’s someone who looks out for his clients and isn’t afraid to speak truth when needed—yet is beloved for his easy laugh.

Grier helps advisors navigate and understand the process of starting an RIA and assists them with the administrative and operational aspects of transitioning a current book of business. Capitalizing on her unique background and years of experience, she’s developed a comprehensive list of things that every advisor should be considering, researching, and executing during the due diligence and planning process.

Robert Sofia is the Chairman and CEO of Snappy Kraken, an automated growth program for financial advisors. During the better part of two decades, Robert has served thousands of companies across the spectrum of financial services, including RIAs, family offices, broker dealers, TAMPs, IMOs, custodians, insurance, and investment companies. Robert has authored three books, and his writings on marketing regularly appear in publications including Forbes, INC Magazine, The Wall Street Journal, FOX Business, Business Insider, Investment News, Financial Planning, Wealth Management, ThinkAdvisor, The Journal of Financial Planning, and many other publications.

Scott MacKillop is CEO of First Ascent Asset Management. First Ascent provides outsourced portfolio management and support services to financial advisors for a flat fee. Scott has been providing portfolio management services to financial advisors for 30 years. Scott started his career as a securities lawyer in Washington, DC. Scott has published over 150 articles and papers on topics including investment management, behavioral finance, marketing, practice management, and regulatory issues. He received the 2019 Investments & Wealth Institute Governance Insight Award and serves as an Ambassador for the Institute for the Fiduciary Standard.

Danielle White is COO of Myriad Advisor Solutions, an all-encompassing premier solution for financial advisors to alleviate demands and challenges of opening and operating a business. Danielle brings 10 years entrenched in the financial industry and business ownership. Danielle is a member of The Association of Accredited Small Business Consultants® to brain share best practices and continually enhance the client experience. She provides a wide breadth of knowledge in business operations from technology, marketing, and human resources for advisors to leverage.

Leigh White is CEO and CTO of Myriad Advisor Solutions, an all-encompassing premier solution for financial advisors to alleviate demands and challenges of opening and operating a business. Leigh has served thousands of advisors and financial firms to navigate the ever-changing developments within the industry. Leigh brings the unique background of owning 5 successful companies over the course of 30 years and over 10 years within the financial industry. She has experienced the trials and tribulations of business ownership and amassed the knowledge and expertise to share.

Brad Wales is the founder of Transition To RIA, a consulting firm uniquely focused on helping established financial advisors understand everything there is to know about WHY and HOW to transition their practice to the Registered Investment Advisor (RIA) model. Brad utilizes his nearly 20 years of industry experience, including direct RIA related roles in compliance, finance and business development to provide independent advice regarding how advisors can benefit from the advantages of the RIA model.

as a lawyer, I can give you the insights...

We are the answer to All Your Questions.

“It’s important that you look at your legal provider and who it is you have invested in to protect your business, so there are a few things you should be asking your lawyer. First, do they know what the heck you’re doing? Do they know the services you provide? The fees you’re charging? Do they understand securities? One of the problems I see when there is a legal action or when there’s an enforcement action, is that so many of you are going to attorneys that have ZERO securities experience! You’re going to, God forbid, a general practitioner!! That’s not the kind of lawyer you want, you want a securities attorney! You want them to understand your business.“

— Leila Shaver Founder

Interesting Rule Upda...

Challenges Facing RIAs Nee...

How To Stay Compliant When...

What does the Outsourced...

Looking To Get Flexi...