Steve’s Corner: Forecast or Fortune Telling?

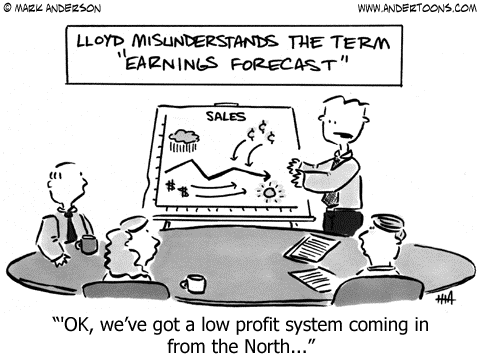

Forecast or Fortune Telling?

A recent survey found that the number one use of smartphones was to access weather forecasts. People plan their activities and actions around these forecasts and have become heavily dependent upon their accuracy in their day-to-day lives. What is truly amazing is that many business owners do not review their company’s forecasts with the same frequency, even though these corporate forecasts are clearly more important to them than the weather. Many companies either have no business forecast available or develop a forecast without much care being taken. In neither of these cases is forecasting being used as the effective corporate tool it has proven to be.

Let’s take a moment to review the often misunderstood and misused corporate practice of forecasting.

What Are the Benefits of an Accurate Forecast?

The major benefit of forecasting is that it provides a logical framework for making future business plans. Planning without forecasting is an impossibility. According to Henri Fayol (a business management pioneer), the essential function of management is to forecast and plan.

Forecasting facilitates managerial decisions. With a logical basis for determining the status of future business operations, management can make correct decisions regarding personnel, sales, and other requirements.

Forecasting is essential to determine future financial needs. Without a correct estimate of financial requirements, a business will either be unable to raise needed capital or not take full advantage of excess capital.

The forecasting process forces those involved to take a detailed look at what drives a business’s success. It is important that all areas of a company are involved in forecasting to keep everyone moving toward the same goals.

What Are the Challenges to Obtaining an Accurate Forecast?

The primary challenge to obtaining an accurate forecast is a lack of standardization. A common (and poor) practice is having each department arrive at its own forecast and try to roll it up into an overall corporate picture. Without a standardized approach, combining these pieces into an accurate enterprise-wide corporate forecast is impossible.

A second problem is that often, there is no quantitative basis for the resulting forecast. Too often, projections are based upon “gut feelings” or “experience” rather than hard, logical, demonstrable figures. Don’t get me wrong, experience is extremely valuable, but a plan based on sound quantitative analysis will provide a solid framework that can be adjusted for these subjective items. This is where an experienced forecasting professional is required to apply the proper quantitative forecasting technique to your organization.

New business lines are not adequately incorporated in a forecast. The usual approach of reviewing historical activity and projecting it into the future will fail to capture these opportunities. This will result in forecast inaccuracies.

Inaccurate forecasts replicate themselves. When faced with erroneous forecasts, organizations will simply put less emphasis on them instead of reviewing in detail the reasons for the inaccuracies. This results in future forecasts being de-emphasized; therefore, their benefits will be lost to the company.

Pulling It All Together

Developing accurate business forecasts is a time-tested and proven business practice. It is essential to the continuing success of your business. Establishing an unbiased baseline forecast is integral to making correct decisions for your organization. Spend some time reviewing your organization’s approach to forecasting and put this tool to work for you.

Ready to move forward? Contact us to move forward with your business forecast. Once engaged, we can review your business and provide an accurate baseline forecast for you to use in your organization.