Tax Planning for Financial Advisors

Tax Introduction

Taxes are one of the largest cash outlays for all small business owners, including financial advisors. There are ways to minimize your tax burden, but it’s important to understand the tax planning process to take advantage of those opportunities. This article discusses tax planning fundamentals and common tax reduction strategies that apply to RIAs and other financial advisors. Regardless of how long you’ve been in business, or even if you’re just starting one, my goal is for you to walk away with at least one good tax savings concept, whether that’s a specific action, something to research further, or a better understanding of tax minimization.

Tax Planning

Let’s talk about the fundamentals of tax planning. Good tax planning/strategy:

- Is built on the decisions you make as you start your business. Initial decisions such as accounting methods and entity structure start your business on the right foot and continue to help you annually.

- Doesn’t start with flashy tax credits and the like. Tax credits often sound exciting (as exciting as taxes can get) but may not apply to you or be worth the administrative hassle and professional service fees needed to take the credit.

- Takes time & attention to understand.

- Requires you to keep complete, accurate, and timely financial records.

- It may need to be revisited based on changes to tax law or your business operations.

- Requires you to understand the financial side of your business – cash flows, cycles/seasonality, margins, etc.

- As the captain for your clients’ team of financial experts, it is no surprise that taxes are only one part of your overall financial health. Getting to short- and long-term financial goals may temporarily increase your tax burden at times, e.g., contributing to a Roth IRA/401K.

- Requires you to be in touch with your tax advisor regularly.

- Generally, but not always, requires you to spend money. Want a low-tax structure? You’ll need to pay for advice from an attorney and CPA to make that happen. Want a current-year tax deduction? You may need to spend money on business expenses or make a deductible contribution to a retirement plan.

- Is dependent on your tax situation. The more complicated your tax situation, the more opportunities for planning.

And when I say “complicated,” here’s what I mean. The tax return on the left is that of an unmarried person with few sources of income. The tax return on the right is that of a married couple, one of whom owns a business, with dependents and multiple income sources.

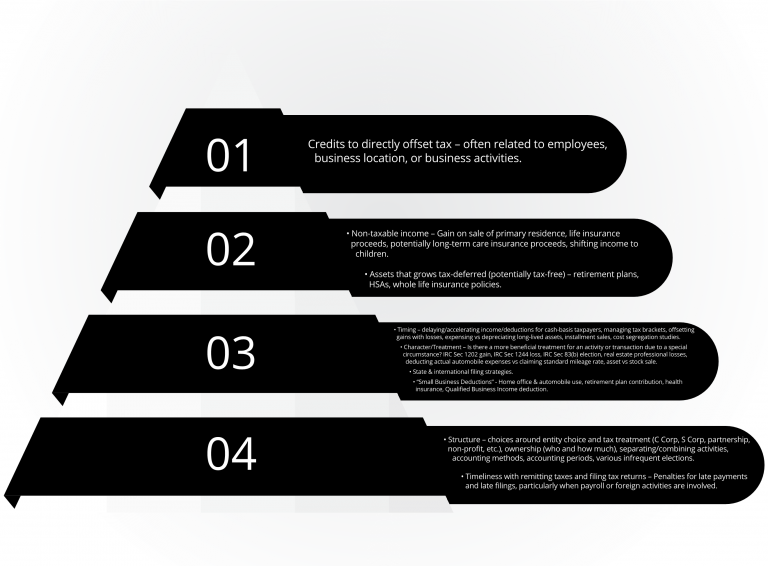

Hierarchy of Tax Strategy

Stated in another way, effective tax planning has a hierarchy to it. It’s like eating a well-balanced meal. The tax planning pyramid looks something like this:

Meaningful tax planning starts at the lowest part of the pyramid – these are decisions that will impact your tax situation year after year. As you work your way up the pyramid, the strategies apply to fewer and fewer taxpayers. Yet, there is a catch: Your level of interest will start at the top since those are the more exciting tax strategies. The lower you go on the pyramid, 1) the more knowledge you need to understand a particular strategy, and 2) the harder it is to quantify the related tax benefits of that strategy because you don’t have a “wrong” choice to compare it to since you are already on an optimal path. The best advice I can give here is to openly communicate with your tax advisor and seek opportunities to learn as much as you can.

Tax Savings

Top tax savings for cash-basis financial advisory firms are as follows. One or more of these may be applicable to your situation. Even if applicable, implementing these may or may not make the most sense for you, and could even increase your tax bill, so it definitely pays to talk to your tax advisor!

- Be on the cash basis method of accounting for tax purposes.

- Conduct business in a tax-efficient structure. This may be an S Corporation, but sometimes is not.

- Take home office & auto deductions as applicable.

- Make deductible retirement plan contributions.

- Deduct health insurance premiums.

- Defer revenue and accelerate expenses.

- Plan around the Qualified Business Income deduction. This is a new business deduction starting in 2018 that will be available to a number of business owners. As you well know, the law for this deduction was written hastily & poorly and interpretive guidance from the IRS is still in progress. Work with a tax advisor to understand how, and to what extent, this deduction applies to you.

No two financial advisory firms are the same, so it is vital to work with a tax planner who gets to know your nuances and offers advice specific to you. It will pay in both the short- and long-term to have expert tax planning at all points of your business’ life cycle. Keep in mind that this is a year-round process. Just as you encourage your clients to reach out to you regularly to keep you apprised of their financial situations, you don’t want to wait until year-end to have these conversations with your CPA. And finally, even with a great tax planner, you have to be involved in the decision-making. If you have questions or want to discuss your own tax situation, feel free to reach out to me for help.

Article by Alicyn McLeod, CPA, CFP®